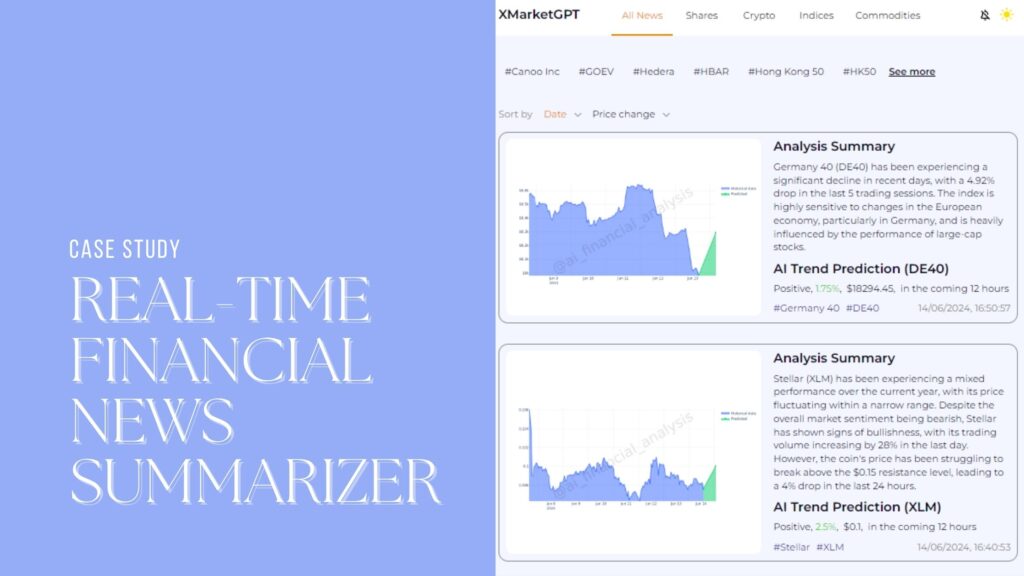

Project Overview

This case study explores the development and implementation of a Real-Time Financial News Summarizer, designed to continuously scan and summarize the latest financial news from across the internet. By leveraging advanced AI technology, the system provides real-time summaries of trends and updates in stocks, shares, cryptocurrencies, and other financial markets. This AI-driven solution ensures users stay informed with concise, up-to-the-minute insights, empowering them to make well-informed investment decisions with ease.

Target Audience

- Individual Investors

- Financial Analysts

- Traders

- Cryptocurrency Enthusiasts

Technologies Used

- Language Model: LLaMA (Large Language Model for AI-based analysis)

- Data Management: Vector Database for efficient storage and retrieval of news vectors

- Natural Language Processing (NLP): Transformers for advanced text processing and summarization

- Real-Time Data Processing: Apache Kafka for continuous data streaming and real-time updates

- Web Scraping: Beautiful Soup and Scrapy for extracting news from various online sources

- APIs: Integration with financial news APIs (e.g., Bloomberg, Reuters) for comprehensive news coverage

- Frontend Development: React.js for a responsive and user-friendly interface

Challenges

- Data Volume and Variety: Handling the vast amount of financial news data from multiple sources with varying formats and reliability.

- Real-Time Processing: Ensuring the system processes and summarizes news data in real-time to provide timely updates.

- Accuracy and Relevance: Maintaining high accuracy in summarizing news and ensuring the relevance of information to users.

- User Trust: Building a system that users can trust for accurate and actionable financial insights.

- Integration: Seamlessly integrating the summarizer into existing financial tools and platforms used by the target audience.

Solutions

- Advanced AI Models: Utilized LLaMA for its superior language understanding and summarization capabilities, ensuring high-quality summaries.

- Efficient Data Storage: Implemented a Vector Database to store and manage news vectors efficiently, enabling quick retrieval and processing.

- Real-Time Streaming: Employed Apache Kafka for handling real-time data streams, ensuring that the latest news is processed and summarized immediately.

- Robust NLP Techniques: Applied transformer-based models to accurately parse and summarize complex financial texts.

- Comprehensive Scraping and API Integration: Combined web scraping techniques with financial news APIs to gather a wide range of news data from reputable sources.

- User-Centric Design: Developed a user-friendly interface with React.js, focusing on ease of use and quick access to summaries.

Outcomes

- Enhanced Decision-Making: Users reported improved decision-making due to timely and accurate summaries of financial news.

- Time Savings: The system significantly reduced the time users spent scanning and reading through vast amounts of news, allowing them to focus on analysis and strategy.

- Increased Engagement: The user-friendly interface and real-time updates led to higher user engagement and satisfaction.

- Scalability: The solution proved scalable, handling increasing amounts of data and users without performance degradation.

- Positive Feedback: Financial analysts and individual investors praised the system for its accuracy, relevance, and ease of use.

Conclusion

The Real-Time Financial News Summarizer demonstrated significant potential in revolutionizing how financial news is consumed and utilized by individual investors, financial analysts, traders, and cryptocurrency enthusiasts. By harnessing advanced AI technologies and focusing on real-time, accurate, and relevant news summaries, the project successfully enhanced users’ ability to make well-informed investment decisions quickly and efficiently. The positive outcomes and feedback highlight the system’s value and potential for wider adoption in the financial industry.